All About How Can I Become An Insurance Agent

More details on fingerprinting for Nevada resident licensing can be discovered here. how to become an independent auto insurance agent. California requires a minimum of 20 hours of approved pre-licensing research study. A new resident applicant who had a present Mishap and Health license in another state within the last 90 days and has a current non-resident license in California or an applicant holding a Life Underwriter Training Council Fellowship (LUTCF), Chartered Life Underwriter (CLU), Licensed Insurance Coverage Counselor (CIC), Licensed Employee Advantage Professional (CEBS), Fellow, Life Management Institute (FLMI), Medical Insurance Partner (HIA), Registered Employee Advantages Consultant (REBC) or Registered Health Underwriter (RHU) classification is exempt from the 20 hours of pre-licensing education.

Nevada has a similar requirement. Candidates must sufficiently finish an approved course of education (of 20 hours) in each field of insurance for which they plan to be licensed. You should be at least 18 years of age and you should pass your state's citizen or non-resident licensing examination to earn cancel sirius xm radio a license.

In California, PSI Providers, LLC, a California-based business supplying state-based regulatory licensure services, handles the scheduling of examinations for people. Individuals may schedule their examinations with PSI either online or by telephone. PSI offers more than 20 websites statewide where people may take their qualifying license evaluation and supply the required finger prints.

More about the California application procedure can be found here.) In Nevada, Pearson VUE is the Insurance coverage Department's only authorized screening supplier. Visits may be made up to one calendar day prior to the day you want to check, based on availability. You can examine the Pearson VUE scheduling options for Nevada here.

On the day of the test, you'll wish to show up 20 to 30 minutes early and bring 2 types of identification (ID) that consist http://garrettwkcz308.trexgame.net/the-7-second-trick-for-how-to-be-a-car-insurance-agent of a signature. Your name on the ID should precisely match the name on your registration. The main identification needs to be government-issued and photo-bearing ID with a signature, and the secondary identification must likewise include a valid signature.

Dept. of State Chauffeur's License U.S. Student's License (plastic card just with picture and signature) National/State/Country ID card Passport Passport Card Armed Force ID Military ID for spouses and dependents Acceptable, non-expired secondary IDs (with a signature) include: U.S. Social Security card Debit (ATM) or charge card Any type of ID on the main ID list above After you have actually made your license, you will require to secure expert liability insurance, also called Errors & Omissions (E&O) coverage.

The smart Trick of How To Become Independent Insurance Agent That Nobody is Talking About

CalSurance offers budget friendly E&O to Word & Brown brokers, and it takes simply minutes to use. Ask us for information, or go here for more information. After you have actually made your license, you typically need to make Continuing Education Credits to preserve it. In California, you're needed to sufficiently total approved courses or programs of guideline or go to workshops equivalent to 24 hr of direction throughout each two-year license duration, including at least 3 hours of principles training, prior to your license can be restored.

Word & Brown, our carrier partners, and the state and local health underwriter associations use a range of CE courses throughout the year to assist you fulfill your mandated licensing renewal requirements. To get info on courses, recorded webinars, and Continue reading events, go to the Word & Brown Newsroom. Word & Brown is dedicated to assisting individuals who want to get in the interesting and progressing world of medical insurance sales.

If you have an interest in using an online course to prepare for your license test, Word & Brown offers a 20% discount rate through the Mike Russ Financial Training Centers; ask us for details.

Select a license type below to look for that license or find out how to: Update your address or name. Print your license. Get continuing education credits. Renew your license.

Couple of markets exterior of the monetary services industry offer the potential for fairly inexperienced professionals to make significant earnings within their first year of work. Within the financial services market, couple of professions use newbies the chance to earn a lot best off the bat as a life insurance agent. In fact, a hard-working insurance coverage agent can earn more than $100,000 in their first year of sales.

It's a difficult field and many individuals burn out earlier instead of later. Insurance representatives hear "no" even more than they hear "yes." It's not uncommon for the "no" to come mixed with a fair amount of profanities and the proverbial door in the face. In addition, lots of people hold insurance agents in low regard, with some people equating them to glorified bilker.

What Does It Take To Be An Insurance Agent for Dummies

The career of a life insurance agent is rewarding however includes continuous hustling, networking, and rejection before a sale is made. Life insurance coverage representatives may be provided a little salary to get begun but are otherwise mostly based on commissions to make a living. Discovering potential customers is difficult and lengthy; getting those clients to purchase as soon as you track them down is even harder.

When searching for a task make certain that you just use to business that are well reviewed by score companies like Moody's and Standard & Poor's. While there are many kinds of insurance (varying from auto insurance coverage to health insurance), the finest money in the insurance coverage field is for those offering life insurance.

Insurance agents offering this type of coverage are either "captive" representatives, which suggests they only offer insurance from one company, or "non-captive," suggesting they represent several insurance coverage carriers. Either way, the common insurance coverage representative is going to spend the bulk of his or her time taking part in some kind of marketing activity to recognize individuals who might be in need of brand-new or additional insurance coverage, offering them with quotes from the companies they represent and encouraging them to sign the new insurance coverage agreement.

In later years, the agent might get anywhere from 3-10% of each year's premium, also known as "renewals" or "routing commissions." Let's take a look at an example: Bob the insurance agent sells Sally a whole life insurance policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 each month or $1,200 each year. Thus, in the very first year, Bob will make a $1,080 commission on offering this life insurance coverage policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As mentioned before, a life insurance representative is not an occupation for the thin-skinned or faint of heart. In truth, more than any other factor, consisting of education and experience, life insurance coverage agents need to have a combating spirit. They must be individuals who love the thrill of the hunt, the rush of a sale, and see rejection as a stepping stone to ultimate success.

Facts About How To Become An Independent Insurance Agent In Texas Revealed

The huge bulk of life insurance business have no official education requirements for becoming an agent. While many prefer college graduates, this basic rule is constantly ignored in favor of the "ideal" candidates. Previous experience in the insurance market is not required since many medium and large insurance coverage providers have internal programs to train their salesmen about the products they're going to sell.

The 2-Minute Rule for How Much Does A Farmers Insurance Agent Make

The profession of a life insurance coverage agent is financially rewarding however involves continuous hustling, networking, and rejection prior to a sale is made. Life insurance coverage representatives might be provided a small income to begin but are otherwise mainly depending on commissions to make a living. Finding prospective clients is challenging and time-consuming; getting those clients to make a purchase when you track them down is finance a timeshare even harder.

When trying to find a task be sure that you only apply to companies that are well examined by ranking companies like Moody's and Standard & Poor's. While there are numerous sort of insurance coverage (ranging from automobile insurance coverage to medical insurance), the very best cash in the insurance coverage field is for those offering life insurance coverage.

Insurance coverage representatives offering this type of protection are either "captive" representatives, which implies they just offer insurance from one business, or "non-captive," suggesting they represent numerous insurance coverage providers. In either case, the normal insurance coverage agent is going to invest the bulk of his or her time taking part in some type of marketing activity to recognize people who might be in requirement of brand-new or additional insurance protection, supplying them with quotes from the business they represent and convincing them to sign the brand-new insurance coverage agreement.

In later years, the agent might get anywhere from 3-10% of each year's premium, likewise understood as "renewals" or "tracking commissions." Let's look at an example: Bob the insurance coverage representative sells Sally a entire life insurance policy that covers her for the rest of her life as long as she continues to make her premium payments.

The policy costs Sally $100 monthly or $1,200 per year. Hence, in the very first year, Bob will make a $1,080 commission on offering this life insurance coverage policy ($ 1,200 x 90%). In all subsequent years, Bob will make $60 in renewals as long as Sally continues to pay the premiums ($ 1,200 x 5%).

As pointed out previously, a life insurance coverage agent is not an occupation for the thin-skinned or faint of heart. In reality, more than any other factor, including education and experience, life insurance agents must have a battling spirit. They must be people who enjoy the adventure of the hunt, the rush of a sale, and see rejection as a stepping stone to eventual success.

How How Do You Become An Insurance Agent can Save You Time, Stress, and Money.

The large bulk of life insurance business have no official education requirements for becoming an agent. While lots of choose college graduates, this general rule is constantly neglected in favor of the "ideal" candidates. Previous experience in the insurance market is not needed due to the fact that the majority of medium and big insurance providers have internal programs to train their salesmen about the items they're going to offer.

Insurance representatives are presently accredited by the private state or states in which they'll be offering insurance. This generally requires passing a state-administered licensing examination as well as taking a licensing class that generally runs 25-50 hours. The sales commission life insurance coverage representatives may make in the very first year if they are on a commission-only income; that's the greatest commission for any kind of insurance coverage.

Most importantly, you'll require to create a resume that highlights your entrepreneurial spirit. You'll wish to include anything that shows you taking initiative to make things happen, whether it was beginning your own service or taking somebody else's business to the next level. Life insurance coverage representatives need to be driven and have the ability to be self-starters.

When you have actually got your resume polished, you'll https://www.inhersight.com/companies/best/reviews/telecommute?_n=112289508 wish to begin finding positions and applying. how much does a life insurance agent make a year. It's really important you don't feel forced to take the very first position that comes along, as working for the incorrect company can both burn you out and haunt you for the rest of your insurance career.

Maybe the very best location to begin in deciding where to apply is to check out the insurer ranking websites for A.M. Finest, Moody's, or Standard & Poor's. From there, you'll have the ability to build a list of companies that have rankings of "A" or greater in your state. These business will typically offer the most-secure items at affordable prices, with a focus on compensating and keeping quality agents.

As soon as you have actually created this list, start taking a look at each business. Due to the high turnover rate of insurance coverage representatives, the majority of companies plainly post their task listings by geographical area, that makes them easily searchable for you. When you find a company in your area that appears to fit your character, get the position as the business instructs on its website.

How How To Become An Independent Insurance Agent In Texas can Save You Time, Stress, and Money.

Numerous insurance business employers will not even talk to a potential agent who doesn't very first make a follow-up call, since this is a strong sign of a prospective representative's tenacity. During your interview, continue to communicate your entrepreneurial and "never state stop" personality, because most managers will employ somebody based upon these elements over all the others integrated.

Your sales manager will be the first to advise you that your only function in life is to find prospective customers. In reality, they'll be far more thinking about how lots of contacts you're making every week than how well you know their product line. Do anticipate to struggle financially for the first couple of months till your very first sales commissions start rolling in.

Numerous agents are now lucky to be made up for one to 2 months of training before being put on a "commission-only" basis. While the life insurance coverage market promises terrific benefits for those who are willing to work hard and tolerate a great amount of rejection, there are two other mistakes you need to be knowledgeable about.

While that might be tempting and appear like a terrific idea to get you began, it can also burn a great deal of bridges with people you care about. Second, you should visit your state insurance commissioner's website and take a look at the problem history versus companies that you're thinking about working for.

Accepting a job with the wrong insurance business will go a long way toward burning you out and destroying your imagine a promising profession. If a career in life insurance coverage sales is something you really desire, take your time and wait on the ideal chance at the ideal business.

Among the most common questions asked by students who enlist in America's Teacher's online insurance coverage representative test preparation courses is a fairly obvious one: "Just how much cash can I anticipate to make?" Fortunately is, a lot of insurance representatives can anticipate to make well above the typical median income.

Not known Details About How To Become A Insurance Agent

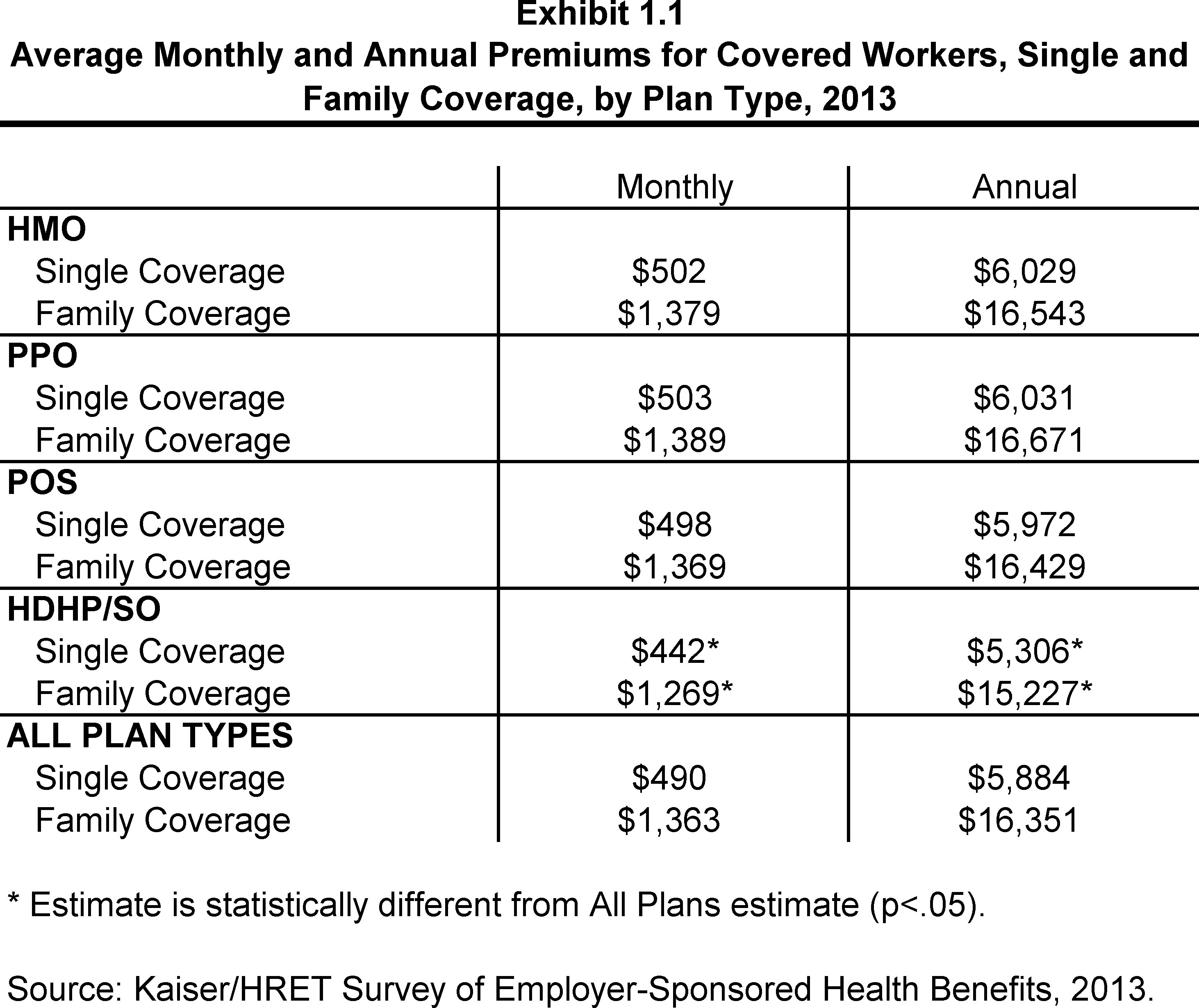

shows that the majority of them can making a comfy income from their work. The most current government data relating to the average income of American insurance coverage agents was assembled in. According to that data from the Bureau of Labor Data: The median annual wage for insurance agents was. The greatest paid 10% of insurance coverage representatives earned more than.

As the numbers reveal, there is a broad variety of possible incomes for insurance representatives. Because the amount of money insurance representatives earn is made up mainly of commissions and bonus offers, the number of sales an insurance coverage agent makes is the greatest aspect that adds to the disparity in between the greatest and most affordable paid of insurance representatives.

Rumored Buzz on How To Become Independent Insurance Agent

Studying is not enabled in the test center. The test administrator will offer you with materials to make notes or calculations. You may not compose on these items before the test begins or remove these products from the screening room. Calculators are permitted just if they are silent, hand-held, nonprinting, and without an alphabetic keypad.

You will have the chance to take a tutorial that will not reduce the exam time. Each major line exam is offered in a multiple-choice format. The test consists of 2 parts: The basic section deals with standard insurance coverage product understanding The state area offers with insurance coverage laws, rules, and guidelines, and practices that are distinct to Texas Each examination consists of "pretest" concerns that are mixed in with the scored concerns and are not recognized.

When you complete the examination, you will receive a rating report marked "pass or fail". Candidates who stop working will get a rating report that includes a numeric rating, diagnostic and re-testing details. Prospects can schedule another test but. InsTX-LAH05 General Lines - Life, Accident & Health 2 hrs 30 minutes 125 25 150 InsTX-PC06 General Lines - Residential Or Commercial Property & Casualty 2 hrs 30 minutes 125 25 150 InsTX-Life01 Life Agent 2 hrs 85 15 100 InsTX-PersPC55 Personal Lines 2 hrs 100 16 116 InsTX-ALAdj16 Adjuster - All Lines 2 hrs 30 minutes 150 0 150 InsTX-PCA81 Adjuster Home & Casualty 2 hrs 30 minutes 150 0 150 InsTX-LHIC42 Life & Health Insurance coverage Therapist 2 hrs 30 minutes 150 0 150 InsTX-LL93 Limited Lines Representative 60 minutes 50 0 50 Fingerprinting is offered at the screening center.

identogo.com or on the phone at (888) 467-2080. You can make an application for your license 24 hr after passing the exam by finishing an application at www. sircon.com/texas. The application procedure should be finished within one year of passing the exam or the test must be retaken. A - how to become a insurance agent.D. Banker & Company provides licensing details as a courtesy to our trainees.

The 6-Second Trick For How To Become A Licensed Insurance Agent In Georgia

A.D. Lender & Company uses no warranty of the precision of this information and will not be held accountable in case of noncompliance with the license requirements. Was this article helpful? Yes No Sorry about that What can we do to enhance? Send Thank you for your feedback!.

With many various types of insurance out there, it's not surprising that that the variety of insurance Look at this website laws keeps increasing. One of these laws, which varies by state in its details, requires anybody wishing to sell insurance to first ended up being accredited in their state. However what does it require to become a licensed insurance coverage representative? Once again, the exact requirements are different in each state, however this short article outlines some of the common prerequisites, consisting of the background check, insurance coverage training courses, and the licensing evaluation.

Many people count on these services to provide a vital safeguard for anything from minor minor car accident to ravaging natural catastrophes or serious illnesses. For that reason, it's easy to understand that states attempt to safeguard customers by requiring a background check and minimum education requirements for insurance representative hopefuls. Some states go further, mandating candidates undergo fingerprinting in order to analyze their state or federal criminal history.

In regards to minimum education requirements, most states are pleased if you have at least a high school diploma. Nevertheless, many employers will want to see a college degree too. Courses in financing, organization, and economics, along with experience in sales are useful when https://www.bloomberg.com/press-releases/2019-08-06/wesley-financial-group-provides-nearly-6-million-in-timeshare-debt-relief-in-july looking for employment later on.

10 Simple Techniques For How To Become A Insurance Agent In Texas

You'll initially need to choose what kinds of insurance you wish to offer, such as life, health, or residential or commercial property and casualty insurance. Then, contact your state's department of insurance to get a list of approved and required courses and course companies. State laws will differ with regard to https://www.dandb.com/businessdirectory/wesleyfinancialgroupllc-franklin-tn-88682275.html the variety of course hours you'll require to finish and the timeframe within which you'll need to get it done (for instance, 40 hours of coursework within 6 months).

After you send your licensing application and complete the pre-requisite training, you'll have to pay a cost and register for your state's licensing exam. Research study products and information about what's checked can often be found on your state's department of insurance website. In addition to concerns regarding the specific kinds of insurance coverage you're wanting to sell, examinations will check your knowledge of insurance basics, rules, and policies.

If you stop working, you should examine your state's rules for when you can retest or how you may tackle appealing the outcomes. For example, in California, if you stop working ten times in a 12-month period, you'll have to wait 12 months prior to retesting. As soon as you pass, you can lastly call yourself a licensed insurance coverage representative, though you'll still require to complete continuing education to occasionally renew your license.

Whether you're a skilled license insurance representative handling a difficult legal problem, or you're an applicant who's hit some legal obstructions to getting your license, let an experienced legal professional explain the relevant insurance coverage laws and assist you fix your concern. Contact a regional insurance lawyer today to get help safeguarding your interests.

Top Guidelines Of How To Find A Good Insurance Agent

Insurance representatives can come from all kinds of academic backgrounds. Oftentimes, representatives can get approved for tasks with only a high school diploma, however some employers prefer a college degree. Completing a degree in service or management, for instance, can be good preparation for a profession in insurance coverage sales, because graduates will be familiar with principles of marketing, economics, and financing.

These courses generally take a few days or more to complete and cover topics that appear on the state licensing evaluation. Students in pre-licensing courses discover insurance principles, various types of insurance coverage policies, and their state's laws as they apply to the type of insurance they desire to offer.

Students find out about the kinds of insurance coverage items their agency sells. They likewise get training in sales strategies and might be matched with a mentor with experience in insurance coverage sales. Each state has various licensure requirements for insurance representatives, and even within a state, these requirements vary depending upon the kind of insurance coverage one offers. Along the way, you might experience legal barriers. If so, you might desire to talk with an knowledgeable attorney who practices insurance coverage law.

It's clear that selling insurance is a financially rewarding profession. Constructing an insurance coverage company is likewise a difficult possibility with an element of danger. Novice agents have a hard time to compose enough policy to survive economically. Competition is fierce and success relies on developing repeat company. Multi-line insurance coverage agents fare the finest because they offer consumers lots of kinds of insurance coverage.

The Best Strategy To Use For How Much Does A State Farm Insurance Agent Make

" We sell an intangible product, and it's based on trust," he stated. "They have to trust you that it works when they need it that you're going to be responsive, that you're going to follow through, jon and amanda d'aleo and that you're going to pay the claim if it's covered. I believe that the trust aspect's a huge deal." In many markets, the choice maker purchasing the insurance coverage for an organization or organization is generally not a younger individual, Cost says.

For lack of a better word, you're simply green. There's always that little bit of doubt and until you get the chance to show yourself, it's really hard to get rid of." One representative informed Insurance Journal in the survey stated that what they like least about being a young representative is constructing the credibility needed to work in the market.

I am confident that things will begin to snowball, and it is just a matter of time until I reach that point." Both Atkins and Cost feel great that their option to become an independent representative was the ideal one in spite of the challenges they have actually faced or will deal with in the future.

I enjoy whatever that I do," Atkins stated. "I feel like with our profession, more than any other occupation, there's a real connection with your clients, like they expect you to be there for them." Her slogan: "Know me, like me, trust me, which's how I want my consumers to feel about me." As far as careers in financial services go, Price believes insurance is the finest choice for youths.

" At the end of the day, people do not have to make investments, individuals do not need to go obtain money, but they require insurance coverage." That need makes insurance a safer bet when it pertains to professions - how much does an insurance agent make a year. "People are constantly going to try to find an insurance coverage, they're always going to look for an insurance agent, and they're going to stick with the one that they trust," Cost stated.

Insurance coverage is too complex. I'm not certified. It's far too late to alter careers. If you've ever considered the steps to ending up being an insurance representative, you have actually likely been exposed to these common misunderstandings and misconceptions about selling insurance coverage. To set the Continue reading record directly, Farm Bureau Financial Services is here to bust the leading myths about ending up being an insurance agent and help make sure nothing stands in between you and your dream opportunity! The truth is, the majority of our representatives don't have a background in insurance sales.

Though a lot of our leading prospects have some previous experience in sales, business and/or marketing, particular characteristic, such as having an entrepreneurial spirit, self-motivation and the capability to communicate efficiently, can lay the best foundation for success in becoming an insurance agent. From here, we equip our agents with focused training, continuing education opportunities and one-on-one mentorship programs created to help them find out the ins and outs of the market.

Getting My How To Become An Insurance Agent In Nc To Work

Farm Bureau representatives discover their career path to be satisfying and rewarding as they help individuals and households within their neighborhood protect their incomes and futures. They comprehend that their business is not just about insurance coverage items - it's about people, relationships and making whole neighborhoods healthier, much safer and more protected.

Our employee are trained on our sales procedure which will help them figure out the finest protection for each client/member or company. The Farm Bureau sales process starts with identifying a prospect, whether you're selling a personal policy or a commercial policy. From there, you can learn more about the possible client/member, find their needs and determine their long-lasting goals - how to become an independent auto insurance agent.

Ending up being an insurance coverage agent is an opportunity for those who choose to be hands-on and forward-facing and those who aim to construct relationships and make a difference. Because of this, we see our representatives as "field workers," working individually with client/members, volunteering within their neighborhoods, getting involved in http://travispksz550.bearsfanteamshop.com/the-of-how-to-become-independent-insurance-agent grassroots networking and showing up at the scene when they're required most.

The reason so lots of client/members choose to deal with local insurance agents over insurance coverage sites is because our agents have the unique capability to tailor insurance plans and offer a level of service that merely isn't possible from a voice on the phone. That's something we simply do not see changing, no matter how "digital" our world ends up being.

A lot of our insurance coverage agents actively network on social networks and develop their own personal representative sites to give users an alternative to get more information about the insurance coverage chances they offer and contact them online prior to meeting personally. It's real that a career in insurance sales isn't your common "9 to 5" task.

On a day to day basis, however, our insurance coverage representatives delight in the freedom that comes with owning their own organization and the versatility it enables in producing their own schedules and working by themselves terms. Becoming an insurance representative for Farm Bureau takes financial commitment, tough work, effort and time to be effective.

In addition to a training and financing program throughout the first 5-8 years, we also offer ongoing support and resources dedicated to growing your earning potential. Farm Bureau's Developing Agent Program lets possible representatives begin constructing an insurance coverage business without stopping their existing task or sacrificing savings to begin.

Some Known Factual Statements About How To Get An Insurance Agent License

The "attempt it on for size" method provides our representatives sincere insight into the expectations and commitment essential for success as a representative, so together we can choose if it's a good fit. While it's real that our agents are accountable for growing their network, Farm Bureau provides each agent with the tools, support and training to take full advantage of success.

Farm Bureau insurance agents begin their opportunity with the Agent Development Program, which reveals candidates exactly how to be an insurance coverage agent and helps them get experience so they are ready to hit the ground running. But the training and assistance does not stop there! Farm Bureau provides a marketing toolkit, on-call assistance and personal sites to help you develop your brand and your organization.

As a Farm Bureau insurance agent, you have an entire team on your side to help you in continuing your success. Our mentoring program uses one-on-one training for representatives at each of their initial client appointments to help agents get the useful experience essential to master skills and take on obstacles.

The majority of individuals believe of insurance coverage in regards to life and car insurance coverage, however there are a variety of other important items to consider. Farm Bureau provides a full suite of insurance coverage items, suggesting our representatives have the ability to assist individuals from all strolls of life - rural, urban and in between - secure everything from their household to their expert dreams.

If you are somebody who is prepared to transition from your past profession to a new one as a Farm Bureau representative, we 'd enjoy to talk with you. A day in the life of a Farm Bureau insurance coverage representative is never the very same! As your own employer, you will set your own schedule, which indicates you can make it as regular or spontaneous as you 'd like.

All about How To Become An Insurance Sales Agent

Independent agents have access to a much bigger part of the insurance coverage industry. Independent insurance coverage representatives can likewise use quotes from multiple insurance provider which can suggest big savings for their customers. They'll try to find the very best worth by discovering the maximum combination of price and coverage. how to be insurance agent. And customers don't have to change companies if their insurance and service requires change.

You don't have to stress over the headache of finding and altering over to a new firm if you deal with an independent agent that provides a variety of protections. An independent company often offers any and all of the following insurance items: Home insurance Tenants insurance Flood insurance coverage Life insurance coverage Auto insurance Bike insurance coverage Organization insurance If you decide to go into company for yourself and you're already dealing with an independent agent that's proven to be responsive, well-informed and honest, you can feel excellent about buying organization insurance from somebody you currently trust - how to become independent insurance agent.

An independent representative is concerned with the quality of the item being provided, and whether its value remains in alignment with its expense provided your special scenarios. A customer-focused agent with experience and specialized understanding can help you understand how a particular insurance item works and why it may be an excellent fit for you.

So a captive insurance coverage representative has the insurer's and frequently their own best interest at top of mind, not the client's. On the other hand, independent insurance coverage companies employ specialists who do not work for a specific insurer, and instead, they work for their customers. Independent insurance representatives represent you, not the insurance coverage company.

There is even an industry association for independent representatives, the Independent Insurance Agents Brokers of America. At Thrive Insurance coverage, we hire agents only if they fit with our culture of effort, outstanding service, and recognition of efforts to assist as lots of people as possible. We provide the very best, most diverse products tailored to fit your requirements.

There are 3 various techniques to purchase auto, property, and medical insurance. These methods consist of going through independent agents, utilizing captive representatives, or purchasing directly through the web. There are pros and cons of utilizing each of the buying options. A fundamental understanding of the differences between the three methods is a great location to inhersight.com/companies/best/reviews/management-opportunities begin.

Purchasing directlyonline or on the phoneyou will handle the insurance service provider. Independent representatives have more flexibility to provide strategies that better fit their customers than do other types of agents. This versatility makes these representatives a strong competitor in the insurance coverage industry. Independent representatives have been around since 1896.

The smart Trick of How To Become An Independent Auto Insurance Agent That Nobody is Discussing

More than 7,100 independent firms are selling on behalf of 43 various insurance providers across the U.S. Quick quotes from numerous insurance carriers are among the major advantages of independent agents (what do the letters clu stand for in relation to an insurance agent?). If you are shopping for insurance coverage, independent representatives are a terrific location to begin due to the fact that they can examine numerous different companies' rates all at when.

Working with a representative who is not exclusively utilized by one carrier is nice due to the fact that you can get unbiased advice. The time-saving factor is substantial due to the fact that you only have to provide your details one time. A good independent agent can be proactive when it comes to your insurance coverage rate. They can get a head start when it concerns ranking changes.

The ability to keep the very same representative even if you change carriers is another perk of having your https://www.globalbankingandfinance.com/category/news/record-numbers-of-consumers-continue-to-ask-wesley-financial-group-to-assist-in-timeshare-debt-relief/ insurance with an independent representative. A strong relationship can be developed with your independent representative, and if your rates start to creep up, your representative can find you lower rates without ever switching agents.

Independent agents offer their customers more options. An independent representative will frequently they will submit your claim with the parent business. Individualized customer service is a high top priority for independent firms. Having a representative makes it so you don't have to deal with the automated 800 numbers rather as often.

However, because they represent several business, the independent representative should be experienced of several various provider products. Likewise, each carrier might set monetary quotas for continued representation. The primary benefit of purchasing through a captive representative is that you will avoid a policy feecharged by many independent representatives. Captive agents have an in-depth understanding of the company's items and can line up those products to their customer's requirements.

The captive agent is paid by the company they represent. In many cases, the pay is strictly a salary and in other cases, it is an income plus a commission. If you have time to go shopping around and call several captive agents, you may find cost differences for the coverage you want.

You may also get multi-policy discount rates by working with a captive agent and using a single business. A main benefit of purchasing straight from an insurance coverage service provider ways you have near-immediate access to the protection. Given that you are just a voice on the phone or an IP address there is little customer support or customization offered.

Facts About How To Get Insurance Agent License Revealed

Discover an extensive list of carriers at IIABA. If you are searching for an independent representative, search for the Relied on Choice brand which is owned by Independent Insurance Agents & Brokers of America. Allied Residential Or Commercial Property and CasualtyAmerican Strategic InsuranceAuto-Owners InsuranceChubbCincinnati Insurance CompanyCitizensColorado Casualty Insurance Co. EMC Insurance Coverage CompaniesFrankenmuth InsuranceGeneral Casualty InsuranceGrange InsuranceThe Hanover Insurance GroupThe Hartford InsuranceIntegrity InsuranceOhio CasualtyPeerless InsurancePenn National InsuranceProgressiveSafecoThe Travelers CompaniesThe Republic GroupWest Bend MutualWestfield InsuranceZurich North America.

An independent representative is an insurance agent that offers insurance coverage offered by several various insurance coverage carriers, instead of just a single insurer. The independent agent functions as a middleman to connect insurance buyers and sellers in order to help with a transaction. An independent representative gets commissions for the policies that he or she sells and is not considered a staff member of any particular insurance coverage business.

Independent representatives are insurance coverage representatives or brokers that are not employed by any particular insurance firm. Independent representatives are, therefore, able to offer insurance policies from multiple business, where they are paid on commission for each policy offered. It is useful for a client to deal with an independent representative since he will have the ability to rapidly research numerous policies and rates across different business.

They take into account the various protection needs of the client and select a policy that provides the essential coverage at a sensible price. An insurance coverage agent that offers policies provided solely by a single insurer is referred to as a captive agent. While the policies provided by a captive representative may be less pricey than those provided by an independent agent, it will be difficult for the client to understand whether she or he is getting the best offer if only one choice is provided.

While independent agents can use their customers with policy options from a variety of various insurers they might not be thought about totally objective. Since the insurance companies pay a commission to the insurance representative when he or she sells a new insurance plan, the representative might push customers to select policies that offer the representative with a greater commission rate.

Rumored Buzz on Why Do I Need Life Insurance

In some jurisdictions, there are laws to dissuade or avoid STOLI. Although some elements of the application procedure (such as underwriting and insurable interest provisions) make it tough, life insurance coverage policies have been used to help with exploitation and fraud. In the case of life insurance coverage, there is a possible motive to buy a life insurance policy, especially if the stated value is substantial, and after that murder the insured.

The tv series has included episodes that feature this circumstance. There was likewise a recorded case in Los Angeles in 2006 where two senior ladies were implicated of taking in homeless men and assisting them. As part of their assistance, they got life insurance coverage for the guys. After the contestability period ended on the policies, the ladies are declared to have had the men eliminated via hit-and-run vehicular homicide.

A viatical settlement includes the purchase of a life insurance coverage policy from a senior or terminally ill policy holder. The policy holder sells the policy (including the right to call the beneficiary) to a buyer for a cost marked down from the policy value. The seller has cash, and the buyer will realize a revenue when the seller dies and the profits are provided to the purchaser.

Although both parties have reached an agreeable settlement, insurance companies are troubled by this pattern. Insurance providers compute their rates with the presumption that a particular portion of policy holders will seek to redeem the cash worth of their insurance policies prior to death. They also expect that a specific part will stop paying premiums and surrender their policies.

Some buyers, in order to take advantage of the potentially big revenues, have even actively sought to collude with uninsured senior and terminally ill patients, and developed policies that would have not otherwise been purchased. These policies are ensured losses from the insurance providers' perspective. On April 17, 2016, a report by Lesley Stahl on claimed that life insurance coverage business do not pay considerable varieties of beneficiaries.

How Much Life Insurance Do I Need Dave Ramsey Things To Know Before You Buy

Investopedia. 2004-01-07 - what is the difference between term and whole life insurance. Archived from the original on 2018-09-07. Obtained 2018-11-28. " Market Summary: Life Insurance". www.valueline.com. ValueLine. Retrieved 2018-11-28. Anzovin, Steven, Famous First Information 2000, item # 2422, H. W. Wilson Business, 0-8242-0958-3 p. 121 The very first life insurance business understood of record was founded in 1706 by the Bishop of Oxford and the financier Thomas Allen in London, England.

Amicable Society, The charters, acts of Parliament, and by-laws of the corporation of the Amicable Society for a continuous guarantee office, Gilbert https://bestcompany.com/timeshare-cancellation/company/wesley-financial-group and Rivington, 1854, p. what is the difference between whole life and term life insurance. 4 Amicable Society, The charters, acts of Parliament, and by-laws of the corporation of the Amicable Society for a perpetual guarantee workplace, Gilbert and Rivington, 1854 Amicable Society, article V p.

The Actuarian Profession. 2009-06-25. Archived from the initial on 2015-09-11. Recovered 2014-02-20. " Today and History: The History of Equitable Life". 2009-06-26. Archived from the initial on 2009-06-29. Obtained 2009-08-16. Lord Penrose (2004-03-08). " Chapter 1 The Equitable Life Questions" (PDF). HM Treasury. Archived from the original (PDF) on 2008-09-10. Obtained 2009-08-20. " Internal Revenue Service Retirement Plans FAQs concerning Profits Judgment 2002-62".

Archived from the original on 8 how to sell my timeshare fast August 2012. Recovered 14 April 2018. (PDF). irs.gov. Archived (PDF) from the original on 2 May 2017. Retrieved 14 April 2018. Archived 2007-07-03 at the Wayback Device August 29, 2006 Rothstein, 2004, p. 38. Rothstein, 2004, p. 92. Rothstein, 2004, p. 65. Kutty, 2008, p.

Archived 2016-08-17 at the Wayback Device website MIB Consumer Frequently Asked Questions Archived 2007-04-15 at the Wayback Machine (PDF). Archived (PDF) from the initial on 2016-06-16. Retrieved 2016-05-24. CS1 maint: archived copy as title (link) (PDF). Archived (PDF) from the initial on 2015-09-15. Recovered 2016-05-24. CS1 maint: archived copy as title (link) " How do Insurance Ranking Classifications Work?".

Some Known Details About Which Parts Of A Life Insurance Policy Are Guaranteed To Be True?

" United States Life Tables, 2001" (PDF). National Vital Stats Reports. 52 (14 ). Archived (PDF) from the original on 17 October 2011. Retrieved 3 November 2011. OECD (5 December 2016). OECD Publishing. pp. 1013. ISBN 978-92-64-26531-8. Black, Kenneth, Jr.; Skipper, Harold D., Jr. (1994 ). Life Insurance coverage (fourth ed.). p. 94. ISBN 0135329957.

Earnings Tax India. Obtained 6 November 2018. " Earnings Tax Department". www.incometaxindia.gov.in. Recovered 2020-05-21. " ITAA 1936, Area 279". Archived from the original on 2011-08-28. Internal Earnings Code 101( a)( 1) " 2018 Insurance Market Outlook Deloitte United States". Deloitte United States. Obtained 2018-11-28. tchinnosian, dennis jay, jim quiggle, howard goldblatt, kendra smith, jennifer. " Scams: why should you worry?".

Archived from the initial on 13 November 2012. Obtained 14 April 2018. " Two Elderly Women Arraigned on Scams Charges in Deaths of LA Hit-Run". Insurance coverage Journal. June 1, 2006. Archived from the original on November 4, 2006. " Life insurance market under examination". cbsnews.com. Archived from the original on 8 December 2017.

There are 2 major kinds of life insuranceterm and entire life. Whole life is sometimes called long-term life insurance, and it encompasses several subcategories, consisting of traditional entire life, universal life, variable life and variable universal life. In 2016, about 4.3 million individual life insurance coverage policies bought were term and about 6.4 million were whole life, according to the American Council of Life Insurers.

The information below concentrates on life insurance sold to individuals. Term Insurance coverage is the simplest type of life insurance coverage. It pays just if death happens throughout the regard to the policy, which is generally from one to thirty years. Most term policies have no other advantage arrangements. There are two basic kinds of term life insurance coverage policies: level term and decreasing term.

How Much Life Insurance Do I Need Things To Know Before You Buy

Reducing term means that the survivor benefit drops, generally in one-year increments, throughout the policy's term. In 2003, essentially all (97 percent) of the term life insurance coverage bought was level term. For more on the various types of term life insurance coverage, click here. Entire life or permanent insurance pays a survivor benefit whenever you dieeven if you live to 100! There are 3 significant kinds of entire life or irreversible life insurancetraditional entire life, universal life, and variable universal life, and there are variations within each type.

The expense per $1,000 of benefit increases as the insured person ages, and it certainly gets really high when the guaranteed lives to 80 and beyond. The insurer could charge a premium that increases each year, however that would make it https://www.inhersight.com/companies/best/reviews/equal-opportunities very hard for many people to pay for life insurance at advanced ages.

By law, when these "overpayments" reach a particular quantity, they need to be available to the insurance policy holder as a cash value if she or he decides not to continue with the original plan. The money value is an alternative, not an additional, advantage under the policy. In the 1970s and 1980s, life insurance coverage companies presented 2 variations on the conventional entire life productuniversal life insurance and variable universal life insurance - how long do you have to have life insurance before you die.

The Ultimate Guide To What Is The Purpose Of Life Insurance

Table of ContentsWhat Does Why Life Insurance Do?Top Guidelines Of Why Get Life Insurance

Lots of insurance provider use insurance policy holders the choice to tailor their (what is the difference between term and whole life insurance).

policies to accommodate their needs. Riders are the most common way policyholders might customize their strategy. There are numerous riders, but accessibility depends on the service provider. The policyholder will generally pay an additional premium for each rider or a cost to exercise the rider, though some policies include particular riders in their base premium. The waiver of premium rider eases the policyholder of making exceptional payments if the insured ends up being disabled and unable to work. The disability income rider pays a regular monthly income in the event the insurance policy holder ends up being not able to work for several months or longer due to a serious health problem or injury. The long-lasting care rider is a type of sped up death benefit that can be used to pay for assisted living home, assisted living, or in-home care when the insured requires assistance with activities of everyday living, such as bathing, consuming, and using the toilet. An ensured insurability rider lets http://beauxbbc276.unblog.fr/2020/10/06/some-of-which-of-these-is-not-a-reason-for-a-business-to-buy-key-person-life-insurance/ the policyholder buy extra insurance at a later date without a medical evaluation. It is essential to review your policy document to understand what risks your policy covers, just how much it will pay your recipients, and under what scenarios. Prior to you look for life insurance coverage, you should evaluate your monetary circumstance and figure out just how much cash would be needed to maintain your beneficiaries' requirement of living or fulfill the need for which you're acquiring a policy. You might look into the expense to work with a nanny and a housemaid, or to utilize business childcare and a cleaning company, then possibly include some cash for education.

Add up what these expenses would be over the next 16 or so years, include more for inflation, which's timeshare get out the survivor benefit you may desire to buyif you can manage it. You may require to update the policy's beneficiaries, increase your protection, and even reduce your protection. Insurance companies evaluate each life insurance applicant on a case-by-case basis, and with numerous insurance providers to select from, nearly anyone can find a budget friendly policy that at least partially meets their needs. In 2018 there were 841 life insurance and annuity business in the United States, according to the Insurance Details Institute. There are also brokers who my timeshare expert reviews specialize in life insurance and know what various business offer. Candidates can deal with a broker totally free of charge to find the insurance they require.

This indicates that nearly anyone can get some type of life insurance policy if they look hard sufficient and want to pay a high enough price or accept a possibly less-than-ideal death benefit. what does term life insurance mean. In basic, the more youthful and much healthier you are, the easier it will be to certify for life insurance, and the older and less healthy you are, the more difficult it will be. Specific way of life options, such as using tobacco or engaging in risky pastimes such as sky diving, also make it more difficult to certify or lead to higher rates. Nevertheless, for rich individuals, the tax benefits of life insurance, including tax-deferred development of money value, tax-free dividends, and tax-free survivor benefit, can offer extra strategic chances. Policies with a cash value or financial investment part can provide a source of retirement earnings. This opportunity can come with high charges and a lower survivor benefit, so it might only be a great alternative for people who have maxed out other tax-advantaged savings and investment accounts. The survivor benefit of a life insurance coverage policy is typically tax complimentary. Wealthy people sometimes buy permanent life insurance coverage within a trust to help pay the estate taxes that will be due upon their death.

This method assists to protect the worth of the estate for their beneficiaries. Tax avoidance is a law-abiding strategy for lessening one's tax liability and ought to not be puzzled with tax evasion, which is unlawful. Technically, you are obtaining cash from the insurance coverage business and using your cash value as collateral. Unlike with other kinds of loans, the policyholder's credit score is not an aspect. Payment terms can be versatile, and the loan interest returns into the insurance policy holder's cash worth account. Policy loans can minimize the policy's death advantage, nevertheless. If you have family who relies on you for financial support, you require life insurance coverage. Life insurance will pay your loved ones a survivor benefit after you pass away that could be utilized to keep footing the bill when you're not around. Married people need life insurance coverage even if they do not have any kids. Even if you're not fretted about loan payments, the survivor benefit might help pay for funeral expenses, which are considerable , or perhaps simply a trip to remove a few of the sting of losing an enjoyed one. If you do have children, they can't be named as a beneficiary without utilizing a complicated loophole in monetary law. Single people may still require life insurance, specifically if they're company owner. You desire your business partner to prosper if you die, so you can name him or her as the recipient.( This is called having an insurable interest. You can't simply name anybody.) Say you're not wed, have no kids, and don't intend on beginning a business with anyone at any time quickly. But what if those plans alter? You might need life insurance later in life, however already you might be ineligible due to a medical condition or find that the premiums have actually ended up being unaffordable. Life insurance coverage rates increase with age. Life insurance will cover most causes of death, whether it's due to illness, accident, or natural causes. That indicates recipients can.

use it for any costs they see fit: spending for daily expenditures, conserving for college, staying up to date with a mortgage, and so on. Find out more about what life insurance coverage covers and what it doesn't. When you purchase life insurance coverage, you're generally buying a death advantage. If you need a higher survivor benefit, you'll.

Everything about How To Buy Life Insurance

pay higher premiums. Add up the costs of any existing financial obligations you show your liked ones, such as any student loans, co-signed charge card, or mortgage payments. That's simply the monetary obligation side. You'll likewise wish to give your partner a comfy standard of living after you're gone and supply money for major costs like end-of-life medical bills and funeral expenses.

Tuition expenses are greater than ever, and a survivor benefit can help spend for all or part of the expenses if you're not around to keep spending for your kids' education. Additionally, any cash leftover can be reserved for your kids till they're old adequate to acquire it. If you call your service partner as a recipient, you need to consider any exceptional organisation loans as well.

as the quantity you add to grow business.